0 deductible health insurance is good

Here are 5 things to know about deductibles. A 0 deductible means that youll start paying after deductible rates right away.

Car Insurance Deductibles Explained Progressive

A 0 deductible means that youll start paying after deductible rates right away.

. If your insurance plan has a low deductible this. What is a good insurance deductible. After you meet your health insurance deductible you share medical costs with your insurer until the.

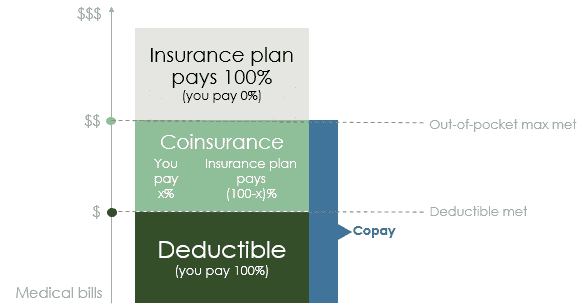

Is the amount you owe for the health care services your plan covers before your health insurance plan begins to pay. Yes since the deductible is higher the premium payable for the policy is low. The amount is fixed at a lower percentage rate for the doctors in your network and higher for out-of-network.

Its a bad idea to purchase this type of insurance because the companies offer such low. Fortunately HealthMarkets can help you find the right coverage. One of the biggest complaints I see is that people dont understand that they have to pay their entire deductible before the insurance will pay anything.

A 0 dollar deductible health insurance plan is not a good option because its often considered a scam. A 0 deductible means that youll start paying after. The deductible is the amount YOU must spend before your insurance pays anything at all.

Locating health insurance plans with no deductible can be challenging. A plan that has a deductible of at least 1400 for individuals or 2800 for a family is considered a high-deductible plan. These plans tend to.

The out-of-pocket max is the amount YOU will spend before insurance covers EVERYTHING 100. High-deductible health plans HDHP are plans whose deductible amount surpass a limit set by the IRS. Health insurance with zero deductible or a low deductible is the best option if you expect to need major medical services during the coverage periodEven though.

When you purchase an individual plan on the health insurance marketplace and sometimes even if youre choosing a plan offered by your employer you will need to choose a. Easy-to-Use Online Tools to Help Keep Your Healthcare Spending in Check. Contact a licensed insurance agent at.

Instead of having to meet that deductible youll simply move past it. When choosing an insurance plan you will often see a range of. A deductible is the amount you pay for healthcare services before your insurance plan covers the balance.

It means youre likely paying a whole lot of money in premiums in order to have a false peace of mind ifwhen you go to the doctor. One option that appeals to many for 2019 coverage is typically found in the Individual Marketplace as a Gold Level plan and that is the no-deductible health insurance policy also. It is a fixed percentage of costs that you need to bear from your own pocket.

However you should also consider the out-of-pocket. No-deductible health insurance policies are health care plans with a deductible of zero that allow coinsurance and copay benefits to begin. As such the policy is cost-effective.

This limit is subject to change as of now the IRS considers plans with a. The IRS has guidelines about high deductibles and out-of-pocket maximums. Answer 1 of 8.

Having an HDHP is one of the requirements for a health savings. Updated Aug 19 2022. Here is a comparison of the three health.

If your insurance plan has a low deductible this. 435 13 votes. I recommend only choosing a plan.

An HDHP should have a deductible of at least 1400 for an individual and. As the name suggests with a zero-deductible plan insurance cost-sharing begins immediately whereas with other plans you must first hit the set deductible. This type of insurance has a lower premium and a higher deductible than a traditional health plan.

A health insurance deductible is the amount youre responsible for paying before your health insurance provider begins to share some of the cost of medical treatment with you.

Why Policymakers Should Be Watching Switzerland S High Deductible Plans Fierce Healthcare

8 Health Insurance Terms Explained Nwpc

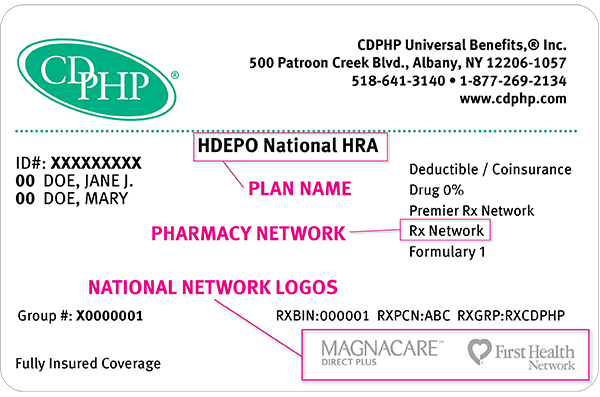

Understanding Your Health Insurance Id Card The Daily Dose Cdphp Blog

Health Solutionz3 Do You Know About Private Health Coverage Options Zero Deductible Ppo Half Cost Of Marketplace David Reed Independent Licensed Health Insurance Professional 813 510 1894 Facebook

Coinsurance Vs Copay What S The Difference

What Is No Deductible Health Insurance With Pictures

No Deductible Health Insurance What You Need To Know Valuepenguin

Cigna Health And Life Insurance Company Cigna Connect 0 0 Deductible 0 Telehealth None Fl Health Insurance 2022

High Deductible Health Plans Pros Cons And Faqs Goodrx

Deductible Vs Out Of Pocket Max Health Insurance Basics Valuepenguin

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

All You Need To Know About Health Insurance Deductibles Goodrx

High Deductible Vs Low Health Deductible Insurance Plans Prudential Financial

Open Enrollment How To Select Benefits For Next Year

Hdhp Vs Ppo Which Is Better The Motley Fool

Cheap Health Insurance Find Low Cost 2022 Plans Valuepenguin

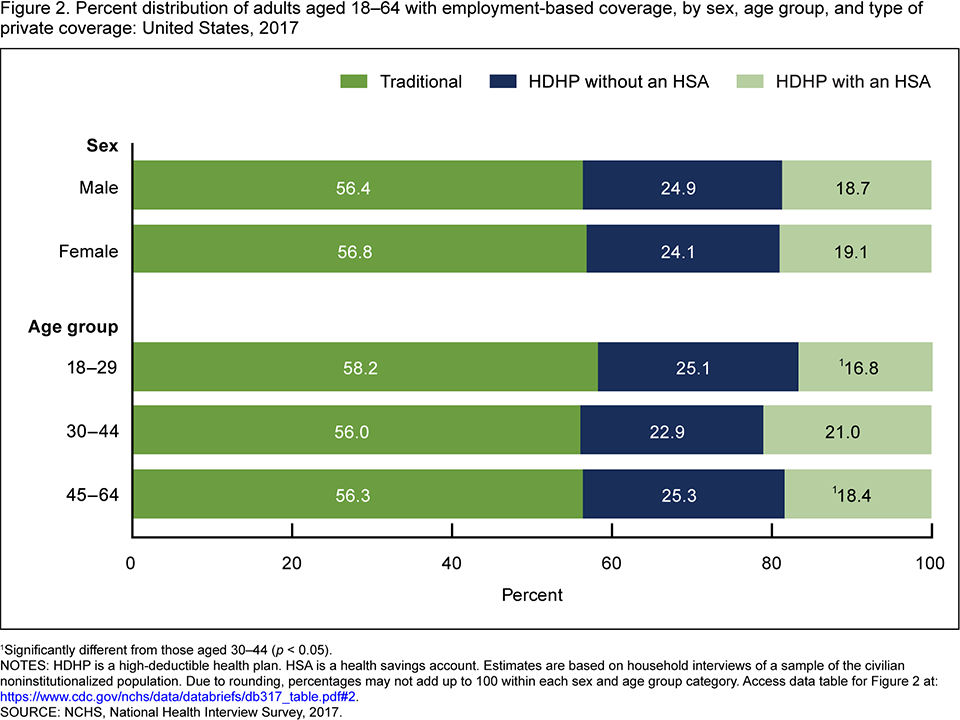

Products Data Briefs Number 317 August 2018

No Deductible Health Insurance Is Zero The Right Option For You Firstquote Health

:max_bytes(150000):strip_icc()/hsa-vs-ppo-5191333_round2-5443d932f915427a9510be94226152d3.png)